new mexico pension taxes

Taxpayers 65 years of age or older. Could increased liquidity give you more control over your 500K in retirement savings.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Ad e-File Free Directly to the IRS.

. Effective for 2022 tax year New Mexico will exempt Social Security retirement income from taxation for individual retirees who make less than 100000 annually. E-File Directly to the IRS State. New Mexico Veteran Financial Benefits Income Tax.

New Mexico is well known for its low costing of living which is 31 lower than the average in the United States. The changed COLA is expected to vary between 05 and 3 each year and average out to 164 annually. Taxable as income but low-income taxpayers 65 and older.

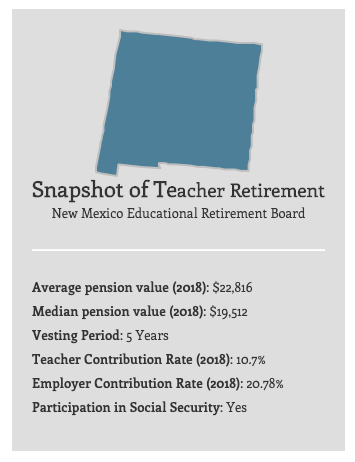

Average pension value 2018. New Mexico allows you to exclude your retirement income of up to 8000 based off of your filing status and your federal adjusted gross income if you meet one of the following. Managing the retirement assets of New Mexico Educators since 1957.

SANTA FE HB 76 passed the House Labor Veterans and Military Affairs Committee with unanimous bipartisan support. Active duty military pay is tax-free. Those whose income is less than 100000 single or 150000 married filing jointly will no longer have to pay state taxes on benefits.

Free 2020 Federal Tax Return. Railroad Retirement benefits are fully exempt but New Mexico taxes Social Security benefits pensions and retirement accounts. E-FIle Directly to New Mexico for only 1499.

The income cut-off is. Its important to note that New Mexico does tax retirement income including Social Security. Starting in 2022 all military retirees may exclude 50 percent of their military retirement benefits New Mexico.

A three-year income tax exemption for armed forces retirees starting at 10000 of military retirement income in 2022 and rising to 30000 of retirement income in tax year 2024. New Mexico on Tuesday joined a. Compared to many other popular retirement.

404-417-6501 or 877-423-6177 or. Beginning with tax year 2002 persons 100 years of age or more who are not dependents of other taxpayers are exempt from filing and paying New Mexico personal income tax. 800-352-3671 or 850-488-6800 or.

Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to 8000 each. 52 rows Tax info. Median pension value 2018.

Disabled Veteran Tax Exemption. Does New Mexico offer a tax break to retirees. However many lower-income seniors can qualify.

New Mexico Educational Retirement Board. Under the state legislation signed Tuesday New Mexico will deliver one-time tax rebates of 250 for individuals who file taxes in New Mexico for 2021 or 500 for joint filers. Ad Download Fisher Investments free guide Is a Lump Sum Pension Withdrawal Right for you.

Placitas located just north of Albuquerque has the lowest tax rate on this list at just 1610 so those looking for a city where they wont have to give too much to Uncle Sam. Retirement Income Is Taxed. Snapshot of Te acher Retirement.

You are 65 or. Removes the 90 percent salary cap on pensionable compensation. The Cost of Living Is Low.

Any veteran who rated 100 service-connected disabled. The bill would support retired veterans by. The state also provides an income tax exemption of up to 3000 to those 65 and older for.

If you plan to supplement your retirement income with investment income remember that you pay tax on all capital gains. New Mexico offers a deduction of 40 previously 50 of all capital gains or 1000 of reported net capital gains whichever is greater. Tax Withholding Understanding your 1099-R Tax Withholding When you fill out your Application for Retirement you have several options for the withholding of federal and Minnesota income.

Retirement income exclusion from 35000 to 65000. Retired Members tax documents 1099-R have been mailed out.

Retirement Security Think New Mexico

New Mexico Retirement Tax Friendliness Smartasset

25 Best Places To Retire On A Budget Budgeting Best Places To Retire Retirement

Average Faculty Salary By Sector Over Time Trends In Higher Education The College Board College Board Faculties Higher Education

Retirement Security Think New Mexico

Retirement Security Think New Mexico

The Most Tax Friendly States To Retire Cheyenne Wyoming Wyoming Best Cities

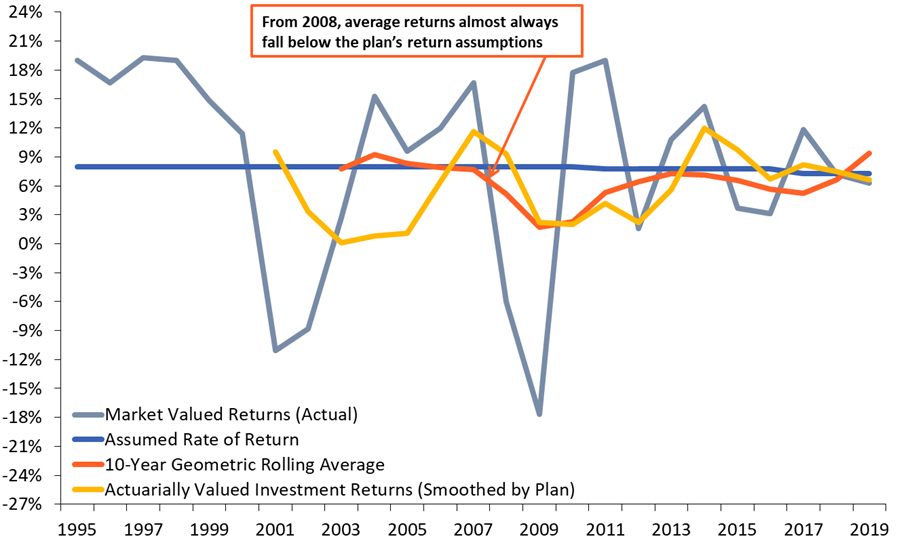

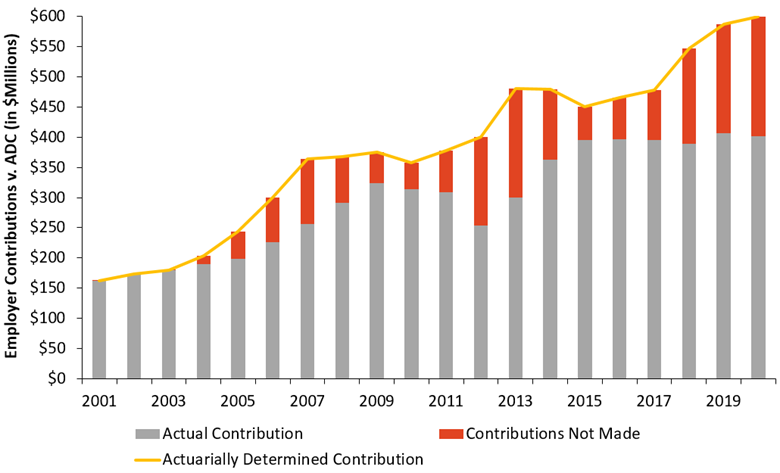

As Debt Grows New Mexico Pension Plan Considers Retirement Benefit Reductions For Teachers Reason Foundation

Retirement Security Think New Mexico

New Mexico Retirement Tax Friendliness Smartasset

New Mexico Teacherpensions Org

Retired And Love N It Premium T Shirt By Grandpastees T Shirt Cool Shirts Shirts

Retirement Security Think New Mexico

As Debt Grows New Mexico Pension Plan Considers Retirement Benefit Reductions For Teachers Reason Foundation

New Mexico Retirement Tax Friendliness Smartasset

State Pension Changes 2019 What Is It And What S Different Than Last Year Pensions How To Plan Retirement Planning

Tax Withholding For Pensions And Social Security Sensible Money

Good Boss How To Plan Business Management

Hilly Areas Of The World Shangri La Hotel Best Hd Wallpapers Pakistan Shangrila Resort Most Beautiful Places Beautiful Places